The best reward card for travel is not what you think

There is a dirty little secret in the world of Mileage Reward Cards. It’s a secret no one else will tell you. In fact, most mile-hoarding travelers don’t even know.

Those miles you’re accumulating on your reward card. They’re not free!

You’d never know that listening to the countless travelers who brag about the “free” flights they get courtesy of their mileage cards. But it’s true. You pay a large price for using a mileage card. I’m not even talking about the annual fee most travel cards now charge.

This dirty secret holds true even for efficient card users who avoid interest charges and late fees by paying off their balance each month. (Anyone who pays credit card interest should strongly consider cutting up their cards regardless of any reward program, but that is a topic for an entirely different blog post).

No, the secret isn’t about how the cards are used (with one exception we’ll address later). It’s about the fact that those travel rewards are earned at the expense of more valuable credit card perks; chiefly cash.

The best credit card for travelers is the one that gets you the most travel, not the most “miles.” Everyone should clearly prefer a card that gives you $600 in cash to one that gives you an airline ticket worth $500.

Loyalty programs try desperately to confuse that simple value proposition, and they do so for a reason. Awarding “miles” allows them to bestow psychic rewards in lieu of actual cash. You feel good about earning 1,000 miles, even though you have only the vaguest idea of what those miles are worth. Similarly, you choose travel reward cards to earn a mile or two for every dollar you spend without knowing whether those miles are more valuable than the cash rebates you could have earned by using other cards. That confusion allows mileage cards to offer less value, and they do.

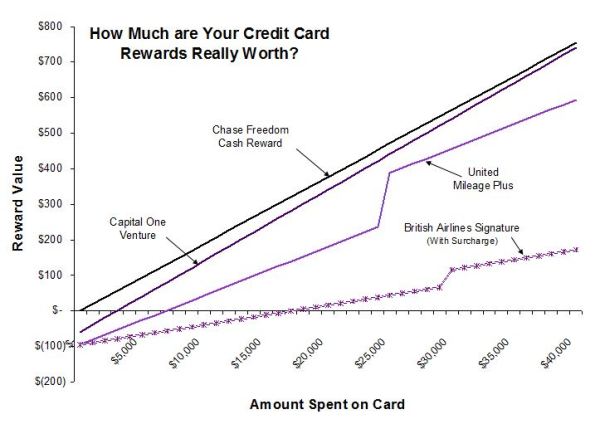

We recently did the math and determined that the best cash-back cards pay at least 45% better than the best pure mileage cards.

For example, we estimate that someone charging $12,000 annually on United’s MileagePlus card will earn miles redeemable for only about $70 worth of travel after deducting the card’s annual fee. Meanwhile, the same spending earns $226 in cash rewards on the Chase Freedom Card. British Airway’s Signature Card doesn’t even earn back it’s annual fee at that level of spending.

The closest competition comes from Capital One’s Venture Card. Although it’s billed as a mileage card, Venture really works more like a cash reward card. Cardholders earn 2 “miles” for every dollar purchased and each mile can be redeemed for $0.01 worth of airfare or an equivalent amount of cash. It’s basically offering 2% cash rewards on all purchases, which is about the best reward we’ve been able to find. The only thing that prevents Venture from beating the Freedom Card is Venture’s $59 annual fee.

If it sounds too good to be true

Surprisingly, the least generous card we investigated was one that initially appeared to offer the best benefits.

The British Airways Signature Card not only awards a signing bonus of up to 100,000 miles (enough for two round trip tickets from the U.S. to Europe) but also an annual companion travel voucher once the cardholder charges $30,000. At first glance, it seemed as if high spending cardholders could earn travel rewards approaching 4% of their purchases. That trounces the meager 1.88% we’re earning with our cash-back Freedom card.

It sounded too good to be true. And indeed it was.

This disclosure buried deep in the fine print essentially moved Signature from first to worst in our credit card smackdown:

At time of publication all reward flights and travel together tickets are subject to fuel surcharges, taxes & fees of approximately $650 per person in economy or $1,100 in business class based on travel from New York to London.

Those massive surcharges applied to mileage redemption significantly reduce the value of the rewards. So much so that most cardholders will not generate enough rewards to earn back the card’s annual fee. Even high-spending folks who qualify for a companion ticket voucher barely come out ahead. We estimate that someone who charged $32,000 to their Signature card in a single year would only realize a net fare discount of about $130 on two round-trip flights to Europe.

You can do better than that with nearly any cash back card. And with a cash reward card, if you choose not to fly you still have the cash in your bank account instead of being in the hole for Signature’s $95 annual fee.

Which is the “Best” Travel Rewards Card?

Which card is best is a moving target, and depends on how the owner uses it. But based on our analysis, no-fee cards offering 2% cash back should easily beat dedicated mileage cards for normal usage. The complex reward formula for the Feedom Card nets us close to 2%, although other owners may experience better or worse results. So your “mileage” may vary with this card.

Another good option for people with Fidelity brokerage accounts is Fidelity’s no-fee 2% American Express card. Capital One’s Venture card is advertised as a mileage card, but is really a 2% cash back card in drag. And while its $59 annual fee makes it a worse option in our opinion than either the Freedom or Fidelity cards, it is still a better choice than the other mileage reward cards.

Pentagon Federal’s Platinum Cash Reward card deserves a special mention. This card gives a whopping 5% cash back on gasoline purchases. For gas-guzzling RVers like us, that adds up to serious mullah over the course of a year. We only use the card for gasoline purchases and our Freedom card for everything else. That pushes our total rewards well above 2% and significantly pads our cash-back lead over the mileage card pretenders.

A Note on “Travel Hacking”

Travel hacking is a phrase used to describe the practice of exploiting travel reward programs for maximum gain. Travel hacking is to rewards programs what couponing is to groceries. And like couponing, travel hacking has some hardcore advocates who claim miraculous savings. Savings that most of us mere mortals would struggle mightily to duplicate, but are theoretically possible nonetheless.

One common travel hacking strategy is to apply for cards offering generous signing bonuses and then cancel the cards after miles are awarded. While we understand that this can be a lucrative technique, our analysis focuses only on the recurring benefits of the four cards in question. We don’t attempt to address the value of gaming promotional bonuses.

United’s MileagePlus card, for example, offers 25,000 miles upon acceptance and 5,000 additional miles for adding a second card user. We value those 30,000 miles to be worth approximately $400, a tidy sum for just opening the account. In comparison, the Chase Freedom card only offers $100 in cash to sign.

For travel hackers who intend to close the account promptly, United’s more generous signing bonus makes its card the better option. But for normal users who plan to keep the account open, United’s $95 annual fee and lower payout on purchases will eventually overwhelm the better signing bonus.

Update: Follow the link for our latest “Best Reward Card for Travelers” article.

a topic worth looking into – the Canadian market has different cards, different programs but you have prompted me to check them out!. thanks

LikeLike

Very good point. I only analyzed U.S. cards. It would be interesting to know if things work differently elsewhere. If you discover anything, please do come back and update us.

LikeLike

Great Post – Great Information for the travelers out there. A deal is not always a deal – been jipped a few times. Have a Great Day!

LikeLike

Yup, it is always important to read the fine print.

LikeLike

Very interesting – I’m wondering how the American Airlines credit card ranks

LikeLike

That is a good question. I selected the cards I did from someone else’s list of “Best Mileage Cards.” I’m not sure if AA was on their list. But looking at the card, it might stack up fairly well (assuming that AA’s frequent flyer program isn’t less generous than United’s). The AA card also has some features that are hard to value, like discounted mileage offers on promotional flights. That kind of thing could be worth a lot to some people and absolutely nothing to others. It’s hard to know, though, without also knowing the details of the promotional flights.

LikeLike

Interesting!

LikeLike

Well, that is an interresting study Brian. I use United Mileage plus and the fee per year on that one is $50.00. Okay , I do hate paying a fee but I allways pay it off each month. So , I acrue little to no interest. I have also gone business class round trip to India and it only cost me $140 in taxes, etc. I think on that trip I did pretty good. In the past I have gotten free flights to Guatemala 3 times , Jamaica , Paris, and Italy. All over about 15 years time. So, it feels like a good deal to me. I guess I consider the $50 fee like putting money away for a ticket. And the tax they add on for the tickets has never been more then the $140 I paid for India. Also, that was business class which would have cost a LOT if i paid for it.

I dont know, but to me if I dont have to put out a big hunk of money at once for a ticket , then it feels like a good deal.

LikeLike

Oh yeah, I should add on that in the old days, they used to have lots of specials such as double your miles from Nov. thru Nov. on every dollar spent, etc. They dont do that anymore. But, it was a way to rack on alot of extra miles.

LikeLike

True. All the cards used to be more generous. The original Discover card was a 5% cash back card. Now the best you can do is about 2% with 5% reserved for specific things. And I think the frequent flyer programs used to require fewer miles to fly, too.

LikeLike

Hi Susan,

The analysis I did used only economy flights. I do think that miles are worth much more when used to buy business class tickets. If you plan on flying business class, then a mileage card may make sense.

I just have a hard time valuing business class travel as highly as the airlines do.

For example, I looked at a mid-week flight on United from New York to Mumbai for this September. A business class ticket cost $6,200 or 210,000 miles. To generate 210,000 miles on United’s card you need to charge $210,000. That same spending would generate only $4,200 on a 2% cash back card. On that basis, the mileage card is better – after all, a $6,200 flight is obviously better than $4,200.

But I can get on the same flight in economy for only $1,200. All of a sudden, that free business class flight starts looking pretty expensive to me. If I can endure 48 hours round-trip in coach and use my cash back card, I walk off the plane in India with $3K more in my pocket than if I had flown business class.

LikeLike

Brian, When I cashed in miles for India it was NOT 210,000!

I believe it was 120,000 for the business class seat and I thought it worth it since it took 26 hours to get there. I am to old and achy to sit in coach for that long. LOL..

United does have a lot of deals where as you can rack in extra miles. For instance shopping at safeway you get double miles if you put it on your card, and some other such places. Not sure how I got so much miles but it was 5 years earlier that I used any and that was for economy to Italy. Somehow I had about 150,000 miles in my account. And it wasnt all from straight dollar per mile charges. They do have deals where you get double miles.

LikeLike

You are correct. After poking around a bit more on United’s site I did find flights to India for 120,000 miles. That significantly cuts the cost, down to about $2,400 making the difference between coach and economy about $1K. Would I pay an extra $1,000 to fly business class to India? Maybe. It sure beats deep vein thrombosis.

And yes, the mileage cards run specials and promotions, but so too do the cash back guys. I’m not sure that tips the balance one way or the other. But be careful in assigning these promotions to your mileage card. Many are not tied to a specific card. The Safeway program, for example, was available to anyone with a frequent flyer number (unfortunately this program ended in 2010).

In any event, I think it’s safe to say that for people who are planning to fly business class, they’ll get more bang for their buck using a mileage card. For economy flights, cash is still king.

LikeLike

You do however have some great info on the cards !!

LikeLike

Comment received from Betty at Heifer12x12 via e-mail (Thanks Betty!)

Fascinating — really !! I am in a death spiral dance trying to get the lowest possible fares on my 12 international trips in 12 months for Heifer, and basically end up traveling on three different airlines to minimize my air miles on all… dohhhh! But I agree about Cap One Venture Card -it’s great (although the rewards requirements are higher: 35,000 vs. 25,000 for domestic travel) –but the real bonus is that they don’t charge the 3% markup on international purchases that Chase does. And let’s face it — NOBODY should be giving JP Morgan Chase another dime given their slimeball derivatives screw-up (again) and their relentless insistence that no banking crapshoot should be regulated… Happy Friday – can’t wait to hear more about Marfa!!

LikeLike

I do carry a Capital One card for international purchases. The fact that they don’t charge extra for foreign currency transactions is an important feature, and one not mentioned in the article. But my Cap One card doesn’t charge an annual fee. I wouldn’t carry it if it did.

With respect to JPMorgan, I personally don’t give them a dime – they send me money. I don’t pay an annual fee and I never pay interest to them. I use my credit card as if it were a debit card, paying off the balance every single month. For the privilege and convenience of lending me money for 30 days each month, they pay me hundreds of dollars every year.

LikeLike

I loathe the foreign transaction fees. They are a super way to lose all the rewards cash one might stack up.

I went with Cap One for several years while living abroad to avoid the foreign transaction fee, but their fraud department has lately moved into panic mode. Nearly every time I tried to make a purchase of more than $100, they shut the card down and I had to call and get them to start me up again. Since I don’t like asking my credit card company (or ANYONE, for that matter) if I can buy a plane ticket, I’m abandoned them for another.

LikeLike

I use Cap One while overseas also to avoid FX transaction fees. We used ours as recently as a few months ago all over Central America and didn’t have a problem with their fraud department. Other cards I’ve had have been super touchy, which is a bit annoying. Hope your experience improves. It’s a good card, otherwise.

LikeLike

Great stuff…I really do need to invest more time in hacking, and getting the most out of it. I’ve had the delta amex for years, but really feel I could work harder in this area….

LikeLike

I joined the Hilton Honors card to get points when I stay at the Hilton in Hawaii which is somewhere I enjoy visiting. I later found out I could only collect points if my trip was booked through the Hilton website which was about 50% more expensive than just booking the same trip through Expedia.

LikeLike

How tricksy. It’s like a game of cat and mouse. If you don’t really take the time to learn how these programs work, it’s a good bet you’re leaving money on the table. Thanks for the heads up about Hilton Honors shenanigans.

LikeLike

Excellent information. I am definitely following you.

LikeLike

Awesome. Thanks.

LikeLike

Great information that clearly took a lot of time on your part to figure out for travelers. I get annoyed when I see articles telling you to open up these cards and reap the rewards of mileage sign up bonuses. I think that is irresponsible for many who can’t afford all of the annual fees that go along with them. Sounds like a cash back option gets you the most for your money and miles.

LikeLike

A lot of the articles I’ve seen don’t really do much analysis. The BA card was ranked by one article as the best travel reward card. I guess they didn’t actually review the program, which is just shoddy work.

LikeLike

Hey Brian, have you ever used Delta’s Gold card? I’m thinking of switching from them to the United Mileage Plus solely because I’ll be living and traveling mostly on the United network (plus, I prefer Star Alliance airlines anyways). They are both $95 annual fee, but so just wondering what kind of criteria I should compare between the two to make final decision. Thanks & great informative article!

LikeLike

Hi Harrison,

I have a couple of thoughts:

1) Miles are worthless if you don’t use them. If you plan on mostly flying United, that alone seems like a good reason to switch from the Delta card to the United one

2) As far as criteria goes, everyone’s frequent flyer programs are different. A Delta mile isn’t worth the same amount as a United mile. Miles redeemed for first class tickets are worth more than miles redeemed for coach. So it isn’t enough to say I’m going to get x miles with one card and y miles with another. The analysis I did tried to convert the miles of each frequent flyer program into a dollar equivalent (if I can get a $400 domestic flight for 25,000 miles each mile is worth $0.16). My advice to you is to do the same analysis with the United and Delta programs using prices for the kinds of flights you mostly expect to take (coach from NYC to Europe, for example). And then I’d see if either of those cards earns back its annual fee when compared with a no-fee 2% cash back card.

Let us know what you uncover.

LikeLike

Great post, I too am looking into how Canadian card companies compare.

LikeLike

Let us know what you find out.

LikeLike

I am grateful for this info – because I always thought going somewhere and paying with miles was a perk, one I did not manage very well reading your blog. thank you so much

LikeLike

Paying with miles does “feel” better than paying with cash. The airlines know this. That’s why their rewards cards can get away with charging annual fees and giving less generous benefits. It turns out, that feeling of getting a free flight actually has a cost associated with it.

LikeLike

Hi Brian,

This information is so valuable, I must share it with my friends and family who travel who have no idea that basically the airlines have consumers thinking that they are actually saving when they utilize a certain charge card when it’s the opposite. However, you have pointed out there is some cards are beneficial even when they cancel. I find it interesting that it is all about money.

LikeLike

So eye opening! Thanks for doing all the work for the rest of us!

LikeLike

In the words of the great Napoleon Dynamite…”LUCKY!”

LikeLike

It depends where I fly to, but on average I fet one free flight on the whole content including Mexico, Canada , US.

I liked the research, which I didn’t do. To me it’s just nice without saving for it when after a year of buying groceries etc, I can book a free flight. Thanks for the math.

And thanks for liking my blog post.

Johanna van Zanten

LikeLike

As someone who is waiting for a suitcase to be returned this is all too complicated for me.

LikeLike

wow this is interesting. I just got finished reading the GRS blog and read your comment which led me over here.

So… it looks like you are saying the Chase Freedom is the best rewards card overall in terms of value (for points or miles or w.e.) because it’s cash back and gives you the most bang for your buck.

I was considering the Jet Blue card for the bonus points you get when you sign up. You get 20,000 points but you have to spend 1000 right after singing up. I guess if I already spend a lot I’d rather be getting rewards.

Right now I Have citi, and their rewards program is the WORST.. DON’T GET IT EVER! You can choose to spend 100 dollars to get 10% off on something (which I wasn’t even going to buy in the first place!) Which makes it challenging to use any of these extra cash” points that I get.

Anyways, thanks for the blog post, I’ll be looking into the Chase Freedom and exploring more of my options.

LikeLike

Fantastic goods from you, man. I’ve understand your stuff previous to and you are just extremely wonderful. I really like what you have acquired here, certainly like what you are saying and the way in which you say it. You make it enjoyable and you still take care of to keep it smart. I can’t

wait to read far more from you. This is actually a great web site.

LikeLike