It is a perennial budget traveler question: which credit card reward gets you the most free travel?

It is a perennial budget traveler question: which credit card reward gets you the most free travel?

Nearly two years ago we did a deep dive into the most generous reward cards and came to a surprising conclusion. For the average user, the best cash back cards handily beat the best travel reward cards. We think that is still largely the case today.

So why, then, are we now ditching our no-fee cash rewards cards for the Chase Sapphire Preferred? Because when the facts change, we change our strategies. And since we last tackled this issue, lots of facts have changed.

Among the most important of those changes is that our cash back cards of choice from two years ago have gotten significantly less generous. The Chase Freedom Card, for example, used to pay us almost 2 cents on every dollar we charged. This past year our earnings came in at just 1.1 cents.

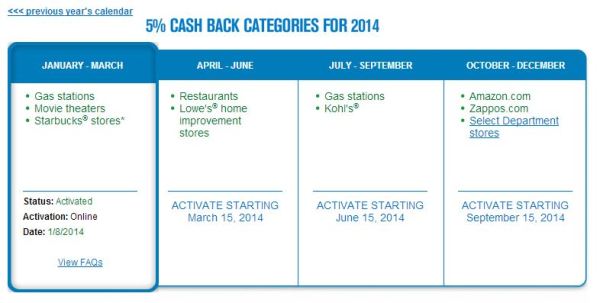

We suspect the declining payout is because Freedom has severely gimped the bonus categories on which they pay 5%. Once upon a time, those categories were broad enough to cover a good portion of our spending. Now almost none of our spending earns the 5% bonus.

Chase Freedom’s bonus categories are mostly worthless now, especially for those of us with a dedicated gasoline rewards card.

Our other major cash reward card also changed for the worse. The no-fee Pentagon Federal Platinum Cash Rewards used to pay us 5% on every dollar of spending at gas stations. It was a great benefit for a couple of full-time RVers like us who spend a big chunk of their monthly budget on fuel. Recently Pen Fed announced they were introducing a $25 annual fee and reducing the payout on gas purchases to 3%.

Even with the skimpier payout, it is still a decent card for anyone who buys a fair amount of gasoline. But that brings us to another significant change: Shannon and I will no longer spend very much on gas now that we’re downsizing to backpacks.

By March we’ll be traveling light through Europe for the foreseeable future. Instead of filling up our monster gas tank, we’ll be buying train tickets and subway cards. Given this life change, and change in our spending patterns, it seemed like a good time to update our credit card strategy.

Considering our previous analysis, our first thought was to investigate other cash reward cards. One of the best from our last article, Fidelity’s American Express Cash Reward Card, is still kicking ass.

Unlike the devalued cards in our wallet, Fidelity’s reward program is unchanged from two years earlier – making it still one of the best cards around. The no-fee card deposits 2% of every single charge you make directly into your Fidelity account. No need to jump through hoops or monitor spending categories or evaluate mileage values. Cash is king, and the Fidelity Cash Reward Card is the one by which all other cards should be judged (see our other article for why we normally believe cash is better than miles).

And yet for our particular spending situation, the Chase Sapphire Preferred has Fidelity’s straight 2% cash back bonuses beat – even after considering Chase’s hefty $95 annual fee. Two things make the Sapphire Preferred a better card for us:

1) It pays double rewards on “Travel” and “Dining.” Starting this March, we expect nearly all of our spending will fall into these two categories.

2) You can transfer Sapphire Preferred rewards at full value to participating frequent flyer programs. 1,000 Chase Reward Points become 1,000 United Miles or British Airways Miles, or Virgin Atlantic Miles, among others.

Sapphire, a 4% Reward Card on Travel

The combination of those two things makes the Sapphire Preferred a powerful reward card. A dollar spent on “travel” earns two Chase Points. Those two points are transferable to some good frequent flyer mile programs where they’re worth between 1.4 cents and 2 cents each. Working out the simple multiplication tells us that a dollar spent for travel on the Sapphire Preferred card earns a cash equivalent reward of between 2.8% and 4%. That is far better than Fidelity’s fixed 2% payout.

But that doesn’t mean the Sapphire is a better card for everyone. How you use your card will largely determine which one you should choose.

Like all cards that carry annual fees, the Sapphire starts you out in a decent-sized hole; $95 dollars in the red, to be exact. To make paying that fee worthwhile, you not only have to earn that money back in rewards, but on top of that you also have to earn at least as much as you otherwise would have earned using a no-fee card like Fidelity’s.

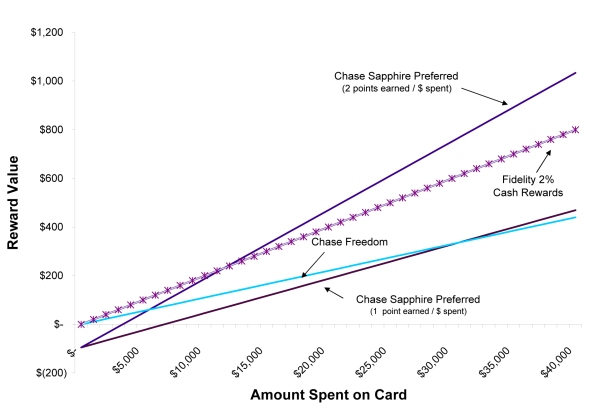

To help demonstrate that concept we’ve prepared a graph comparing the rewards earned using various cards at different spending levels. We included two calculations for the Sapphire Preferred card; one where all spending qualifies for double rewards and one where none does. Most real-life users will earn something between these two lines because some spending will earn double points while the rest will only earn single point rewards.

How Much are Your Credit Card Rewards Really Worth?

But even without knowing exactly how your spending breaks down between bonus and non-bonus categories the graph gives us some useful information. For example, we can tell how much you need to spend on “Travel” and “Dining” each year to earn more on the Sapphire Preferred card than you could have gotten from Fidelity’s cash back card. That’s the point on the graph where Sapphire’s double reward line crosses Fidelity’s line. Those two lines cross at about $11,000 in annual spending.

But even without knowing exactly how your spending breaks down between bonus and non-bonus categories the graph gives us some useful information. For example, we can tell how much you need to spend on “Travel” and “Dining” each year to earn more on the Sapphire Preferred card than you could have gotten from Fidelity’s cash back card. That’s the point on the graph where Sapphire’s double reward line crosses Fidelity’s line. Those two lines cross at about $11,000 in annual spending.

Therefore, if you don’t expect to spend more than $11,000 each year on travel and dining, then you’ll likely be better off with Fidelity’s 2% card.

For the sake of preparing these numbers, we’ve assumed a value of 1.4 cents per frequent flier mile. If you cash in your miles for tickets worth less than that, you’ll have to spend more on the Sapphire card than what we’ve shown here. However, we think the 1.4 cent valuation is pretty conservative. We snagged our upcoming flight to Madrid for exactly 2 cents per mile. At that kind of exchange rate you only need to spend $5,000 on bonus categories to blow past Fidelity’s 2% payout.

The other thing you can see from this graph is that if you don’t spend anything on “Travel” and “Dining” the Sapphire Preferred is almost always worse than even my gimped Chase Freedom card. And it’s significantly worse than the Fidelity card.

What this also tells you is that the best earning strategy is to carry both the Sapphire and the Fidelity cards (and maybe even the Pen Fed card if you spend a lot on gasoline.) Use the Sapphire for travel and dining, Pen Fed for gas and Fidelity for everything else.

The moral of the story is that the best cash back cards are still pretty hard to beat for most users. But for those of us who spend a lot on travel, the Chase Sapphire Preferred is an even more rewarding choice.

If you are traveling in Europe, an issue with U.S. credit cards is the lack of a chip as a security measure. Also important to take into consideration are transaction fees charged for converting currency. Capital One is an example of a card with reasonable fees. But you probably know all this!

LikeLike

All good points, so much so that we were planning to write a whole other article to discuss those things too. Nonetheless, I probably should have mentioned here that the Chase Sapphire Card is chip enabled and has no foreign currency transaction fees.

LikeLike

The Target security breach has been on my mind as we have had to replace debit cards and get new PINs which is such a pain. For me, being able to use a card securely overseas is more important than its cash back feature. Sounds like the Chase Sapphire is as good as their ads. You might remind your readers to let their card companies know when they will be traveling out of the country.

Keep up the good work! Your new adventure in Europe sounds wonderful to this old lady.

LikeLike

That’s the reason we don’t use debit cards. If someone drains your bank account you have little recourse. With credit cards, as long as you report the breach in a timely manner your liability is limited to $50 and often times $0.

LikeLike

Thanks for doing the analyses for us!

We plan on traveling for 2-3 weeks in Europe this summer – will we really need a chip & pin credit card? I don’t think we did in Copenhagen a year ago, but how much have systems switched over? Any idea?

LikeLike

Hi. As someone living in Madrid, I thought I’d give my 2 cents. Personally, I only use cash or chip-and-pin here, because you never know which places won’t accept cards without a chip, and they are everywhere. You can’t use the ticket machines for the metros, you can’t eat at most restaurants, etc. In Spain there are tons of places that refuse to accept cards at all, chip or no. I’m sure it partly depends on the country, so I would look more specifically at the places you plan to go. Have fun! 🙂

LikeLike

We haven’t been to Europe in quite some time, so we can’t answer that question from first hand experience. We’ll know more in a couple of months. 😉

LikeLike

I was going to post exactly what Liz did about foreign conversion fees and chip and pin. I checked into the Case Sapphire Preferred card, and unfortunately it is a chip and SIGNATURE, not a chip and PIN card. Pity, as I was getting excited when I saw that the annual fee is currently waived.

While we’re on the subject of fees, you also need to find out what your bank will charge for ATM use. I have a Capital One checking account I keep just for travel that has zero foreign conversion fee, zero foreign ATM fee, and refunds the first $25/month charged by foreign ATMs. I don’t think that account is currently available to new customers, but you will get a much better deal from a Credit Union than from a bank like Wells Fargo. The Andrews Federal Credit Union is one of the few outfits offering true chip and pin cards, too.

LikeLike

Wow, you’re really jumping the gun on that other post we had planned (about both chip and pin and avoiding ATM fees). Unfortunately not many U.S. credit cards do the chip and pin (most require signature) but we’ll have more to say on the subject soon. 😉

LikeLike

(Sorry about that, ;>) Good article on pin vs signature here: http://www.cardhub.com/edu/chip-and-pin-vs-chip-and-signature/

If I were headed to Europe this year I’d get an Andrews CU chip and pin card (I had problems buying train tickets last time), but I think my mag stripe Cap One will still be fine for South America.

LikeLike

Good analysis. I currently put everything on my Starwood Amex. It’s hard to determine the payout, but we stayed in $700 a night rooms in Venice for free. That was only one of many trips that were covered. Of course, as a follower of Dave Ramsey, I almost hate talking about credit card rewards reminding folks not to use credit cards if they can’t pay off balances.

LikeLike

Yup, the paying off balances every month thing should go without saying – but probably should be said anyway.

LikeLike

Very interesting and thorough job on this one. I’ve used a regular Chase Sapphire for a few years now and got decent rewards off it in the US. When I bought a new computer with it in Thailand though, I was charged a significant percentage as a ‘foreign transaction fee’.

Apparently you need to pay a yearly fee to stop this, and presumably get your favoured Sapphire Preferred card, but I just don’t use it enough to warrant that.

LikeLike

Yeah, the Preferred card does offer good benefits over the regular Sapphire but those benefits come at a price of $95 per year. Typically we wouldn’t ever pay an annual fee for a card. But we feel confident we’ll easily earn back our annual fee because of our spending patterns. The average card user probably won’t though and would be better off with a no-fee card.

LikeLike

Reblogged this on morristownmemos and commented:

Thanks for figuring this out for us; we were just having this conversation this week, saying it’s impossible to use the miles for airline travel or upgrades any more. Any opinions bout some other bank cards, like Bank of America?

LikeLike

We’ve had no problems using miles to book flights – even for emergency same-day flights. Upgrades have gotten nearly impossible, though, unless you have high ranking elite status with the airline.

I took a quick look at the Bank of America travel rewards card and it seems like a relatively straight forward no-fee ~1.5% cash back card, although they’re a little coy about what their reward points are actually worth. To use points to book travel you have to go through the BoA site, which probably limits the flights you can choose. For a mileage reward card I’d probably still prefer the Chase Sapphire Preferred and for a cash back card the Fidelity Amex.

LikeLike

Thank you for sharing as travel lovers is very good to know!

LikeLike

We used our Sapphire Preferred in New Zealand (where they expect chip and pin) with no problems expect they have to find a pen for you to sign with! An interesting thing we find using it is that because it’s a heavier card it’s a real conversation starter. Almost every person who holds it comments on it. We’ve come to expect our little card chats whenever we buy anything.

LikeLike

Too funny. The heaviness of the card is the first thing we noticed when it arrived in the mail.

LikeLike